New to Leander ISD or considering your options?

Explore Leander ISD campuses and programs on the Begin website.

For Every Student. Always.

Student Transfer Info for 2026-27

Priority Transfer Window: Jan. 5-23, 2026

Open to currently enrolled families.

Open Transfer Window: Feb. 2-May 29, 2026

Open to both in-district and out-of-district families.

Long-Range Planning

As part of long-range planning work, Trustees approved the consolidation of Faubion Elementary beginning in the 2026-27 school year. Planning will continue this spring to support students, families and staff through the transition, including attendance boundary rezoning.

Trustees also confirmed that Steiner Ranch Elementary will remain open for 2026–27, allowing recently approved enrollment strategies time to take effect while enrollment trends continue to be monitored.

Learn more in Board Briefs recapping the Dec. 17, 2025 meeting.

Bond & Construction Projects

News & Announcements

Enroll Today

New to the area or looking to register your student in Leander ISD? Enrollment for the 2025–2026 school is open.

Quick Links

Calendar

District events and year-at-a-glance academic calendars

Home Access Center

The parent and student portal for grades, schedules, and student info

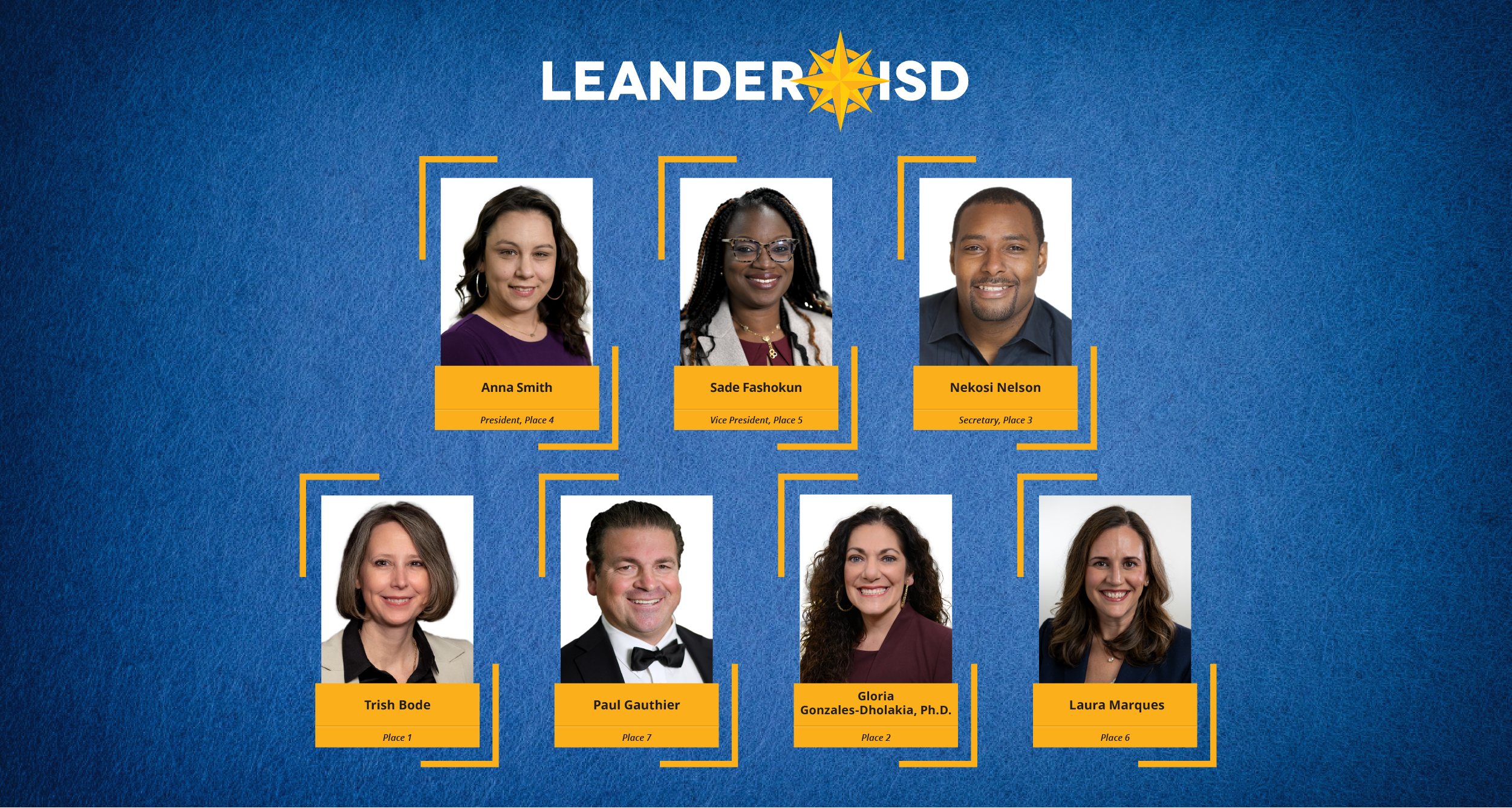

Board of Trustees

Meeting agendas, bios, elections, schedules, and news

Bus Information

Place to register (new and returning bus riders), obtain bus information, register for SMARTtag and more

Meals & Menus

Menus, online ordering, meal balance and payment portal

Attendance Zones

School boundary and assignment areas

ParentSquare

The notification platform used to connect with families and staff through text, email and app

Graduation

Graduation information for this year’s class of seniors

Safety & Support

Learn about our anti-bullying efforts, access Anonymous Alerts, and see notifications from safety incidents

Registration

Place to enroll new students for the 2025-26 school year

LaunchPad

Log-in portal for student and staff digital resources and applications

Support

Articles to answer frequently asked questions and critical topics

Grievances & Complaints

Parents and community members wishing to contact the school board regarding a grievance or complaint.

Financial Transparency

Annual financial reports, budget information, energy usage and more

Summer School

Course information, registration and transportation for the summer

Leander Educational Excellence Foundation (LEEF)

A nonprofit dedicated to enriching the educational experience for Leander ISD students and staff