Attendance Credit Election (ACE)

Authorizes

Required Recapture Payments

Prop A is an Attendance Credit Election, which allows voters to approve the process by which the school district makes mandatory recapture payments to the state. If Prop A passes (FOR), LISD will make its required recapture payments.

Avoids Detachment of Territory

If Prop A fails (AGAINST), LISD would be subject to a Detachment of Territory, meaning the state could detach a portion of the school district’s total property value.

Keeps Current Tax Base Intact

If Prop A fails (AGAINST), LISD could need to raise the interest & sinking (I&S) tax rate to pay existing debt with a smaller tax base after some territory is detached.

Voter-Approval Tax Rate Election (VATRE)

Results in Lower Tax Rate

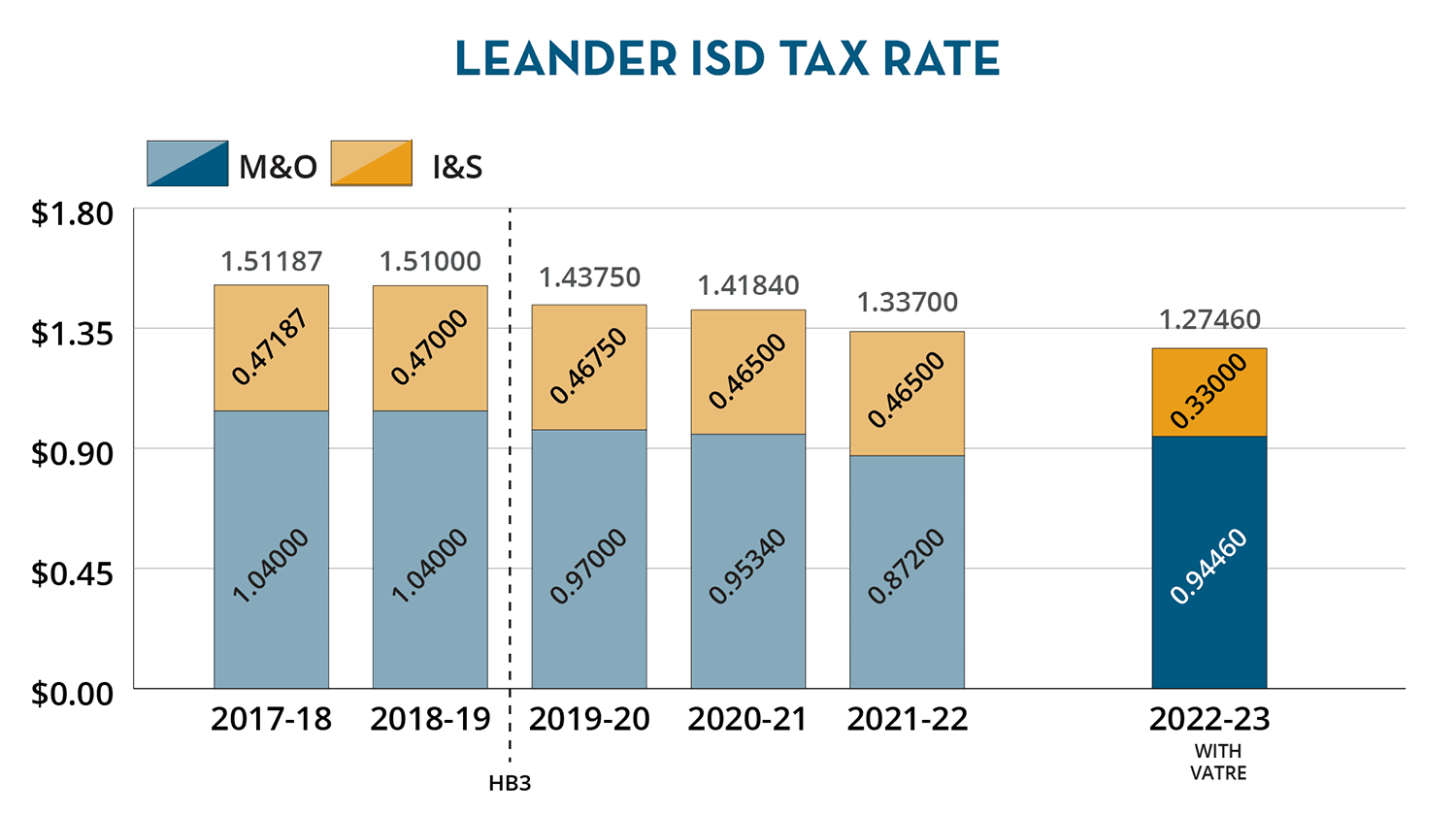

Prop B would add 9 cents to the LISD tax rate for maintenance and operations (M&O). Due to a decrease in the district’s tax rate for interest and sinking (I&S), Prop B would still result in a reduction of 6.24 cents in the overall tax rate.

Funds Teacher & Staff Raises

If Prop B passes (FOR), LISD will raise revenue needed to reduce future deficits and fund the compensation plan enacted earlier this year, which provided raises of 5% for teachers and 4% for all other employees.

Helps Address Budget Shortfall

If Prop B fails (AGAINST), LISD will face a budget shortfall that could cause reductions in our workforce and academic programs. The shortfall could impact future compensation increases.

Informational Videos

Prop A: Attendance Credit Election (ACE)

When a school district’s property values have reached a point where they begin to send money back to the state through recapture, state law requires an Attendance Credit Election – also known as a Chapter 49 Election – for voters to approve the process by which the school district makes these mandatory recapture payments if such an election was not held previously.

If passed (FOR), the school district would make its mandatory recapture payments to the state as required under Texas law.

If the measure fails (AGAINST), the school district would be subject to a “Detachment of Territory,” meaning the state will detached a portion of the school district’s total property value. As a result, the school district might need to raise the I&S tax rate to pay existing debt.

For a more detailed explanation of an Attendance Credit Election, visit the ACE section of the Finance 101 page.

Ballot Language

“Authorizing the Board of Trustees of Leander Independent School District to purchase attendance credit from the state with local tax revenues.”

Prop B: Voter-Approval Tax Rate Election (VATRE)

If the Board of Trustees adopts an M&O tax rate that is greater than the calculated rate set by law, this triggers a VATRE. If the voters do not approve the VATRE, then the M&O rate reverts to the maximum allowed under state law.

If LISD voters, by approving Proposition B, ratify the tax rate adopted by the Board of Trustees, the district would raise $32 million. This revenue would fund the pay raises for teachers and other employees approved by the Board in May 2022. Importantly, even if the VATRE is approved, the overall property tax rate in LISD will be 6.24 cents lower than last year’s rate, due in part to a decrease in the I&S portion of the tax rate.

If the VATRE does not pass, the district would lose out on any additional revenue and could be left with a budget deficit of nearly $35 million for the 2022–23 school year. While fund balance would cover the costs for that school year, the school district would need to make spending cuts that could result in fewer teachers working in the district. LISD would also consider restructuring or eliminating certain programs that LISD students and families have come to expect.

Understanding the Ballot Language

Due to requirements from the state, Proposition B will read as follows:

“Ratifying the ad valorem tax rate of $1.2746 in Leander Independent School District for the current year, a rate that will result in an increase of 35 percent in maintenance and operations tax revenue for the district for the current year as compared to the preceding year, which is an additional $99,041,063.”

Here are three important things to understand about the ballot language:

- The resulting overall tax rate of $1.2746 is a $0.0624 decrease from 2021–22.

- The ballot references the increased maintenance and operations (M&O) tax rate, but does not mention the more than 13-cent decrease in the interest and sinking (I&S) rate.

- The revenue increase that is referenced in the ballot language reflects gross tax collections over the prior year. It does not consider recapture or the loss of state funding. The net increase in funding as a result of passing Prop B would be $32 million.

Impact of Prop B to Homeowners

The increase in the tax rate for Maintenance & Operations under Prop B would be offset by an even larger reduction in the Interest & Sinking tax rate, which is used to pay debt. That’s how Proposition B would result in a tax rate that is 6.24 cents lower than last year’s rate.

An average-value home in Leander ISD has an assessed value of $694,944 and a taxable value of $423,031. If voters approve Prop B, the tax bill due on this home would increase by $453, which comes out to $38 per month more than last year’s tax bill.

Limit on School Taxes for Senior Citizens

School property taxes are frozen for homeowners who qualify for a homestead exemption because they are disabled or age 65 or older. Their taxes can go down, but not up. Therefore, if you have the exemption for age or disability, your taxes will not increase if voters approve Prop B.

Voter Information

Propositions A & B in Leander ISD will come at the bottom of a lengthy Fall 2022 ballot, one full of federal, state, and local elections. In this section, we will attempt to tell you all that you need to know regarding the process and timing of voting.

Key Dates

Voter Registration Deadline

Start of Early Voting

Deadline for counties to receive mail-in ballot requests

Election Day

If you need to update your name and/or address, check out this link from the Texas Secretary of State website.

Remember that Monday, Oct. 11, is the last day to register to vote!

Early Voting & Election Day Hours

- Monday, Oct. 24, through Saturday, Oct. 29: 7 a.m. to 7 p.m.

- Sunday, Oct. 30: 12 p.m. to 6 p.m.

- Monday, Oct. 31, through Friday, Nov. 4: 7 a.m. to 7 p.m.

- Tuesday, Nov. 8: 7 a.m. to 7 p.m.

Voting Locations

You must vote in the county in which you reside. However, in both Williamson and Travis counties, you can vote early — and on Election Day — at any voting site in the county.

Early Voting Locations: Williamson County

Early Voting Locations: Travis County

Election Day Locations: Williamson County

Election Day Locations: Travis County

Voter ID Requirements

Under Texas law, voters who possess one of the seven acceptable forms of photo ID must present that ID at the polls when voting in person. Voters who do not possess and cannot reasonably obtain one of the seven approved forms of photo ID may fill out a Reasonable Impediment Declaration (RID) at the polls and present an alternative form of ID, such as a utility bill, bank statement, government check, or a voter registration certificate.

Here is a list of the acceptable forms of photo ID:

- Texas Driver License issued by the Texas Department of Public Safety (DPS)

- Texas Election Identification Certificate issued by DPS

- Texas Personal Identification Card issued by DPS

- Texas Handgun License issued by DPS

- United States Military Identification Card containing the person’s photograph

- United States Citizenship Certificate containing the person’s photograph

- United States Passport (book or card)

Resources

Have a question? Submit your question through Let’s Talk or by texting 512-399-0068.

Information Sessions

- Presentation Slides

- Request an in-person informational presentation

- In-Person & Virtual Information Sessions: Let’s Learn with Bruce

Print & Digital Materials

Additional Resources

- Smart Money: School Finance website | Finance Explainer video

- Visit the Financial Transparency page for detailed information about the district’s finances.

- Efficiency Audit Report – August 2022

- Notice of Voting Order Priority for Voters with Certain Disabilities

- Notice of Attendance Credit Election – English

Notice of Attendance Credit Election – Spanish - Notice of Voter-Approval Tax Rate Election – English

Notice of Voter-Approval Tax Rate Election – Spanish - Notice of Regular Election for Trustees

- Sample Ballot for ACE and VATRE Elections

- Sample Ballot for Board of Trustee Elections

Frequently Asked Questions

If tax rates are going down, why am I still paying more on my tax bill?

The tax rate in LISD is going down, but the average value of homes in LISD have gone up significantly from the prior year. The tax bill you owe is based on the value of your home and the tax rate. In most cases, the increase in value produces a larger tax bill than last year even with the decrease in the tax rate.

When we say, for prop A, "make the required recapture payments," do we actually make payments monthly or all in one lump sum to the state? Why?

School districts that owe recapture to the state and do not generate enough state aid to “net” recapture typically make a single payment before the end of the fiscal year in August.

Why Leander ISD does not just set a lower tax rate in order to avoid paying recapture at all?

Under state funding formulas, LISD cannot lower the tax rate enough to avoid recapture. Taxing below a certain rate (known as the state-approved Maximum Compressed Rate) causes a loss in funding and even more recapture.

Why does Texas Education Agency information pertaining to recapture for Leander ISD show that Leander ISD is estimated to owe $0 dollars in recapture for 2022-23?

The short answer is TEA is using an estimated property value increase of 4.36%. They will update their data in February. The actual property value increase is 27.05% which will equate to a recapture payment of approximately $31.2M which is greater than state revenue of $17.7M and as such the payment cannot be offset against state aid. Thus, LISD is required to conduct the Prop A election to authorize the method by which Leander ISD makes the required recapture payment.

Here’s the answer in greater detail. Leander ISD received a letter from TEA that states the district will exceed the district’s entitlement under Texas Education Codes (TEC) §48.266(a)(1) and/or TEC §48.266(a)(5)(B), which essentially means Leander ISD will owe recapture. The letter also states that the “determinations for districts subject to recapture are based on:

- estimates of enrollment for school year 2022–2023, and

- estimated property values for tax year 2022. Because the agency does not yet have final state certified property values for tax year 2022, the agency is using 2021 state certified property values increased by 4.36%”

TEA is using estimates of enrollment for 2022-2023 which were required to be provided in December 2020. Subsequent changes in enrollment and attendance projections are reflected in the district estimate, but not in the estimate TEA is using. Also, the data utilized by TEA does not reflect the 27.05% property value increase, it does not consider the final certified “Tier One Tax Rate” (MCR), and it does not account for the copper pennies that are being requested via the VATRE.

The letter from TEA also states that the final determination for the recapture payment will be made based on “using the district’s:

- final enrollment, entitlement, and local share under TEC, Chapter 48,

- final state certified property values for tax year 2022,

- adopted maintenance and operations (M&O) tax rate for tax year 2022, and

- M&O taxes collected by your district in 2023.”

LISD requested the Texas Association of School Business Officials (TASBO) to run the calculations based on up-to-date information; i.e. 2022 certified property values, enrollment, and assuming the VATRE passes. The results of that calculation can be found in this updated calculation, recapture is estimated to be $31,216,055.

In February 2023, TEA will incorporate preliminary certified state values, the certified tax rate, Fall enrollment, and budgeted tax collections in their calculations and will provide a new excess local revenue estimate. The recapture amount owed by Leander ISD will not be finalized until August of 2023 and will be based on actual enrollment and actual property value as certified by the comptroller’s office.

What is the difference between Proposition A and Proposition B?

Proposition A is a state-required vote in which residents of the district approve the method by which Leander ISD sends recapture dollars to the state. The purpose of recapture is to provide roughly equal amounts of revenue per student across the state, as required by prior Texas Supreme Court rulings. It is often referred to as Robin Hood.

Proposition B is an opportunity for LISD residents to ratify the tax rate set for Maintenance & Operations (M&O) by the LISD Board of Trustees on August 18, 2022. If voters approve Proposition B, the total tax rate will be 9 cents higher than it would be if voters defeated Proposition B. The $32 million raised by Proposition B would fund recently enacted pay raises for teachers and other staff, and it would help prevent cuts to the LISD workforce and programs.

What happens if Proposition A passes?

If voters pass Prop A, the district will proceed with making its required recapture payment to the state.

How much money will the state take out of LISD through recapture this year?

LISD estimates our recapture payment to the state will be $31.2 million for the 2022-23 school year.

Instead of paying recapture, why not just lower the tax rate and collect less in property taxes?

Under state funding formulas, LISD cannot lower the tax rate enough to avoid recapture. Taxing below the state-approved Maximum Compressed Rate (MCR) causes a loss in funding and more recapture.

What happens if Proposition A fails?

If voters reject Prop A, the state could embark on a Detachment of Territory, meaning that parts of the district’s property tax base would be taken off of the Leander ISD tax rolls, even though the district would still be responsible for educating students who live in those areas. In other words, a smaller base of taxpayers would be responsible for paying off debt and the district would have less revenue to fund education.

What would the passage of Proposition B mean for LISD?

The passage of Prop B would provide an additional $32 million for education in Leander ISD. This revenue would help recruit and retain teachers and provide funding for the compensation plan that the Board of Trustees approved in May. The revenue would help protect against future budget cuts that could leave fewer teachers employed in the district and reduce the availability of academic programs.

How much revenue would Prop B raise?

It would raise $32,468,580 for the 2022-23 year.

How would the impact of Proposition B affect the taxes due on an average-priced home?

What would be the tax impact on homeowners who are 65 or older?

School property taxes are frozen for homeowners who qualify for an exemption based on age (65 or older) or disability. Their taxes can go down, but not up. Prop B will not increase frozen levies.

Would the revenue raised by Proposition B pay for projects proposed in last year’s bond election?

No. Bond elections are primarily for construction and physical infrastructure. The money raised from Prop B would go into classroom learning (including teacher salaries), rather than construction and renovation.

What happens if Proposition B fails?

If voters do not pass Prop B, the district will need to make significant spending reductions that could impact instructional programs and cause a reduction in the district’s workforce in 2023-24. The failure of Prop B would also jeopardize future pay raises for teachers and other staff.

How would Proposition B impact the property tax rate?

The overall tax rate, which is the combination of the M&O rate and the I&S rate, would be 6.24 cents per $100 property valuation lower than the rate for 2021-22.

How could the district raise more revenue while also having a lower tax rate?

First, state-mandated rate compressions have pushed the M&O rate down. With those compressions, under Prop B, the M&O rate would increase from 87.2 cents to 94.46 cents. However, the I&S rate would decrease from 46.5 cents to 33 cents. This significant reduction in the I&S rate is what would allow for a decrease of 6.24 cents in the total tax rate under Prop B.

What types of spending cuts will be needed if Proposition B fails?

Based on current projections, the district will need to make $29.5 million in spending cuts in 2023-24 if Prop B fails. $29.5 million equates to 458 teaching positions.

Would the passage of Proposition B cause recapture?

No. The district will have to pay recapture to the state regardless of whether Prop B is successful.

What will the Proposition B ballot language say?

Due to specific requirements in state law, Prop B will read as follows on the ballot: “Ratifying the ad valorem tax rate of $1.2746 per $100 of valuation in Leander Independent School District for the current year, a rate that will result in an increase of 35 percent in maintenance and operations tax revenue for the district for the current year as compared to the preceding year, which is an additional $99,041,063.”

Here are three important things to understand about the ballot language:

- If Prop B passes, the resulting overall LISD tax rate of $1.2746 would be a $0.0624 decrease from 2021–22.

- The ballot references the increased maintenance and operations (M&O) tax rate, but does not mention the more than 13.5-cent decrease in the interest and sinking (I&S) rate.

- The revenue increase that is referenced in the ballot language reflects gross tax collections over the prior year. It does not consider recapture or the loss of state funding.

How can I receive updates regarding Propositions A & B?

Text @LISDMoney to 81010 and you will receive regular text updates.

When is the election?

The last day to register to vote is October 11.

Early voting is from October 24 to November 4

Election Day is Tuesday, November 8.

Where do I vote?

Williamson County voters can vote at any location within the county. The same is true for Travis County: Voters can vote at any location within the county they are registered.

Trustee Elections

All school board positions are four-year terms. Five trustee positions will be on the Nov. 8, 2022 ballot. For additional information, visit the Board Elections page.

Bond Elections

As Leander ISD looks to keep up with growth and take care of existing schools, future Bond elections are an option being considered by the Board of Trustees and the district’s Long-Range Planning Committee. Additional information on the district’s long-range planning for growth.

In November 2021, voters approved proposition B to fund $33.3 million to replace technology devices but voted against propositions A and C to fund new construction, renovations and technology infrastructure projects. For additional information on the 2021 Bond, visit the Bond page.