About Finance 101

On this page, community members can learn the basics of school finance in Texas. Included is an overview of how districts are funded and where the money goes; definitions of key concepts and common acronyms; and frequently asked questions.

Budget Mechanics

Money Coming In (Revenues)

Public schools in the state of Texas are funded from three main sources: local school district property taxes, state funds, and federal funds, with the majority of funding coming from local property taxes collected by school districts and state funds.

The Basic Allotment (BA) is set by the Texas legislature, guaranteeing every school district a certain amount of funding for each student based on their Average Daily Attendance (ADA). The BA is currently set at $6,160 per student, with additional funding based on district and student characteristics. The district’s Tier 1 Entitlement is determined by this Basic Allotment and the characteristics of students in the district.

The Tier 1 Entitlement is covered by a sharing of the state with the local district. The state covers a specific portion from the Available School Fund and then local tax collections are applied to determine whether or not the state contributes additional funds.

- Example 1: If the district’s local tax collections cover the Tier 1 Entitlement, then only Available School Funds are distributed.

- Example 2: If the district’s local tax collections do not fully cover the Tier 1 Entitlement, state funds are received to make up the difference in addition to the Available School Funds.

- Example 3: If the district’s local tax collections cover the Tier 1 Entitlement to the extent that no additional state aid (above Available School Funds) is needed to cover the total cost, then the district is required to send the tax collections exceeding the Tier 1 Entitlement back to the state through the mechanism known as recapture.

This creates a relationship between local and state funds where when local tax collections increase, state funds to a school district decrease.

Local

Local tax dollars make up the majority of the district’s revenue sources. The school district’s board of trustees sets the local property tax rate each year while the county appraisal district determines the market value of property within the county or district.

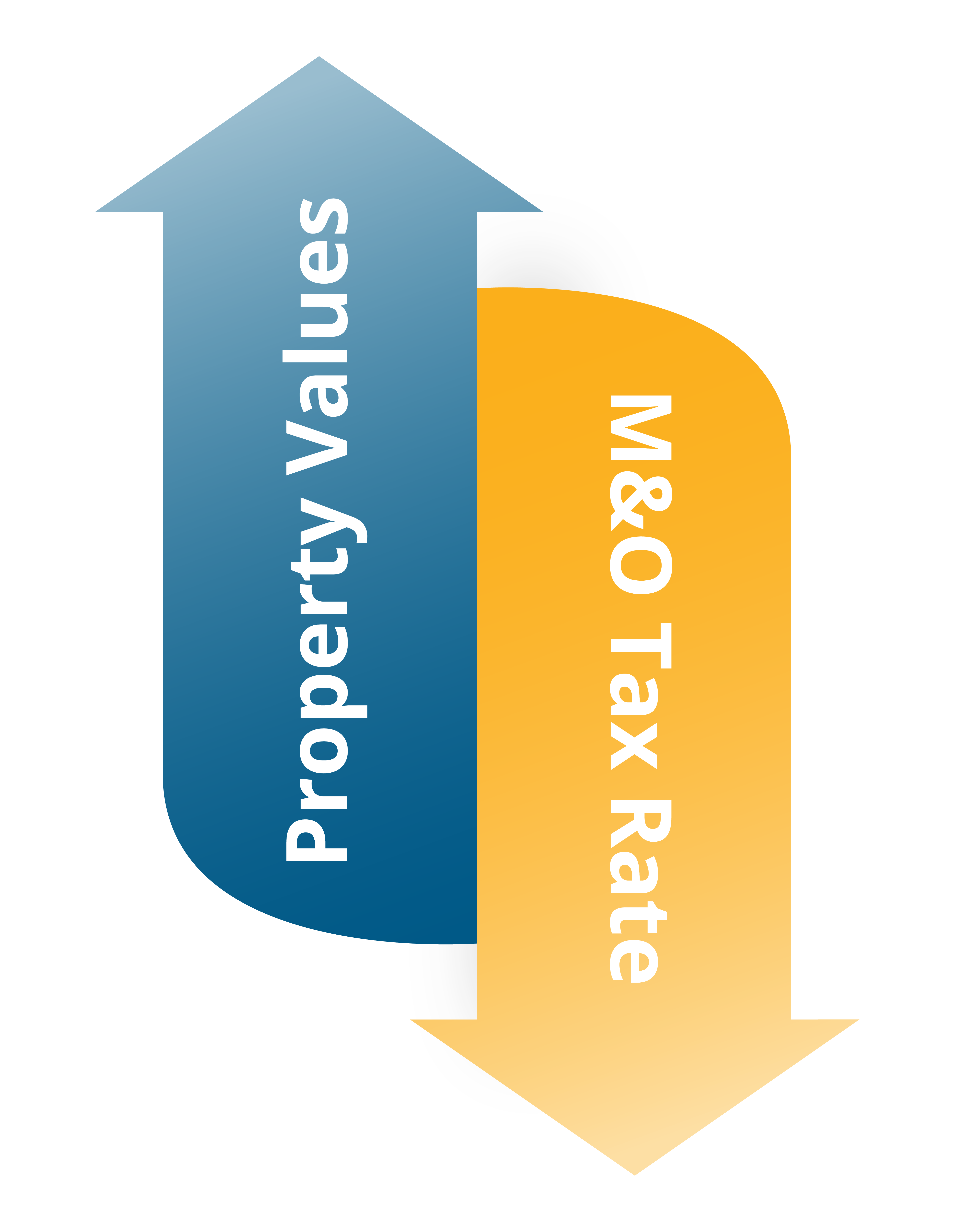

In an area like Leander ISD where home values are rapidly increasing, even when the tax rate stays the same or is lowered, homeowners will likely see an increase in the total amount of taxes owed due to the higher property values. HB3 requires a lowering of the M&O tax rate in an effort to offset the impact of rising property values; however, the lowered M&O tax rate does not fully accomplish this objective.

State

The amount of state revenue earned each year is determined by the Tier 1 Entitlement calculation and in Tier 2 by the guaranteed yields on the golden and copper penny portions of the tax rate.

When local property tax collections do not fully fund the Tier 1 entitlement, state revenues are earned. When local property tax collections result in more revenues than are necessary to cover the Tier 1 Entitlement, the district sends those excess tax collections to the state through a mechanism called recapture.

In Tier 2, if the golden pennies and copper pennies do not produce the required revenue per student, then additional state revenues are earned. There is no recapture on the tax collections generated by the golden penny portion of the tax rate; however, the copper penny revenue is subject to recapture.

As local tax collections increase, state funds to a school district decrease.

Federal

Federal funding for Texas school districts varies from district to district based on various federal grants and formulas. For the operations of Leander ISD, federal funds in the General Fund equate to about 1 percent of total revenues and are generated from indirect costs charged to the federal grants and programs related to special education services.

Most federal revenues received by a school district are accounted for in Special Revenue Fund groups and not the General Fund.

Maintenance & Operations (M&O)

Funding coming into this bucket is primarily used for operating the district. Employee salaries and benefits; student educational resources; classroom supplies and equipment; and contracted services – like utilities, insurance, legal and audit services, etc. – are paid from this source of funding.

To relate this to the average community member, this is similar to things like car fuel and routine maintenance, groceries, clothing, cleaning supplies, and utilities like electricity and water.

Compression of the M&O tax rate – or the automatic reduction of the M&O portion of the tax rate introduced as part of HB3 – is meant to limit revenue growth from local property taxes to about 2.5 percent each year. Because of this, an increase in property values does not equal a proportional increase in revenues to the district.

The M&O funding source is split into two tiers: Tier 1 and Tier 2.

Tier 1

The Tier 1 Entitlement is based on the Basic Allotment (BA), as set by the Texas legislature, guaranteeing every school district a certain amount of funding for each student based on the Average Daily Attendance (ADA). The BA is currently set at $6,160 per student, with additional funding depending on district and student characteristics such as transportation miles/costs and fast growth.

Maximum Compressed Rate (MCR)

A portion of the tax rate that generates revenue to fund the Tier 1 Entitlement. Each year, the MCR is recalculated by TEA. Compression is based on the comparison of statewide property value growth and local property value growth, and the extent to which they exceed 2.5 percent.

Tier 2

Funds that enrich the educational offerings a school district provides students – on top of the Basic Allotment, currently set to $6,160 – fall into M&O Tier 2. Examples of these enrichments include small class sizes and specialized programs or courses that go beyond those required in the Texas Essential Knowledge Skills (TEKS). Funding in this tier comes in two forms: Golden Pennies and Copper Pennies.

Golden Pennies

A portion of the tax rate that brings in revenue above the Tier 1 Entitlement and is not subject to Recapture, meaning 100 percent of the revenue generated from this part of the tax rate stays in the district. They are referred to as “golden” because of their high value to a school district and because state aid can be generated to fully fund the calculated entitlement.

Leander ISD currently uses 5 golden pennies as part of its M&O tax rate and has access to the remaining 3 golden pennies – a total of 8 allowable golden pennies – through a VATRE.

Copper Pennies

A portion of the tax rate that brings in revenue above the Tier 1 Entitlement and can generate additional state aid but is subject to recapture. Current estimates for 2022 project 60 percent of this revenue would stay in Leander ISD and 40 percent would be sent back to the state as recapture.

Leander ISD currently does not use any copper pennies as part of its M&O tax rate and has access to 9 copper pennies through a VATRE.

M&O Funds Restrictions

Can Use Toward …

- Employee salaries

- Employee benefits

- Student educational resources

- Classroom supplies and equipment

- Utilities

- Insurance

- Legal and audit services

Cannot Use Toward …

- Paying debt when raising M&O rate while lowering I&S rate.

Interest & Sinking (I&S)

Funds from this portion of the tax rate can only be used 1) to pay off bonds sold for construction and capital improvements to facilities and 2) to buy furniture, equipment and/or to purchase land. I&S funds cannot be used for operational costs, such as salaries and benefits, nor can these funds be used to construct facilities. They can only be used to pay down outstanding debt. A school district can only take on new debt through a voter-approved bond election.

I&S funds cannot be used for operational costs, such as salaries and benefits, nor can these funds be used to construct facilities. They can only be used to pay down outstanding debt.

To relate this to the average community member, this is similar to the purchase of big-ticket items like a new home, house renovations, kitchen appliances, new mechanical systems or a new car.

Revenue generated from this portion of the tax rate is not subject to recapture and is directly linked to property value growth without a cap. Because of this, an increase in property values does equal an increase in total revenues for debt repayment.

Fast Growth

As a fast-growth district, Leander ISD has had to build additional campuses to accommodate student growth. Since 2010, LISD has opened 9 new campuses, with the 10th new campus opening in Fall 2022.

The only way to fund the construction of new campuses is for the district to issue debt or use General Fund fund balance. Using only the General Fund to build campuses is not an option, though, because of the sizable cost to build new schools; therefore, the district has issued bonds to finance facilities.

In 2015, the district started restructuring outstanding debt and took aggressive steps to pay down debt early. This Debt Progress Report from June 2021 describes the significant reduction in the district’s debt since 2015.

Citing the district’s strong debt management and budgeting practices, Fitch Ratings upgraded the district’s credit rating in September 2021 to “AA” from “AA–”, where it had been rated by Fitch since 2012. Recently affirmed in September 2022, the district now carries “AA” ratings from two of the major credit rating agencies, S&P and Fitch Ratings.

I&S Funds Restrictions

Can Use Toward …

- Paying off bonds sold for construction, renovations

- Early repayment of outstanding debt

Cannot Use Toward …

- Construct facilities

- Capital improvements to facilities

- Employee salaries

- Employee benefits

- Student educational resources

- Supplies and equipment

- Utilities

- Insurance

- Legal and audit services

Money Not Staying with a School District (Recapture)

Recapture is the state’s mechanism for making sure that a district with really high property values does not have more funding than a neighboring district without those high values.

The state provides more funding to school districts with lower local property tax revenues; less state funding to districts with a strong source of local property tax revenues; and requires districts with the highest local property wealth per student to give some of their local tax revenue back to the state. This latter option is referred to as recapture payments, also known as Robin Hood payments.

The money sent back to the state through recapture comes from money generated from the M&O portion of the tax rate that generates more revenue than that needed to fund the Tier 1 Entitlement or excess revenues generated on copper pennies above the yield.

When a school district’s property values have reached a point where they begin to send money back to the state through recapture, state law requires an Attendance Credit Election – also known as a Chapter 49 Election – for voters to approve the process by which the school district makes these mandatory recapture payments if such an election was not previously held.

Money Going Out (Expenditures)

A visual breakdown of the district’s budget is represented in the Education Dollar graphic below. A large portion of each dollar is spent in the classroom on instructional costs. When looking for cost reductions, it is difficult to make a significant reduction without impacting the classroom.

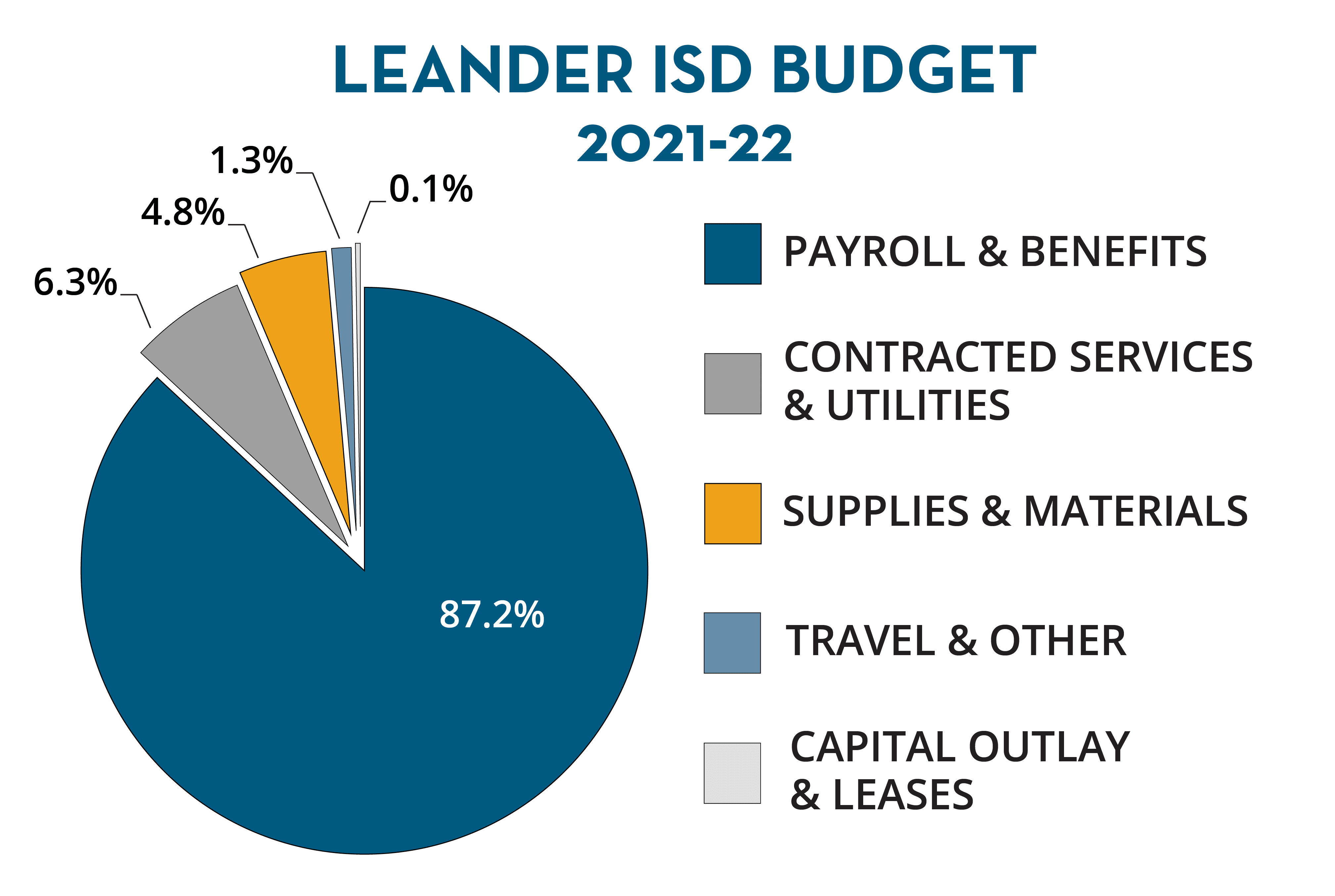

In Leander ISD, payroll costs of roughly $337 million made up 87 percent of the 2021–22 budget, which totaled $387.5 million. Payroll costs include paying teachers, librarians, instructional aides, bus drivers, custodians, principals, administrators and all of the 5,262 employees of the district.

Budget Breakdown

- 87.2% on payroll and employee benefits

- 6.3% on contracted services and utilities

- 4.8% on supplies and materials

- 1.3% on travel and other operational costs

- 0.1% on capital outlay* and leases

*Capital outlay includes large equipment costing more than $5,000, including some technology equipment, band instruments and athletic equipment.

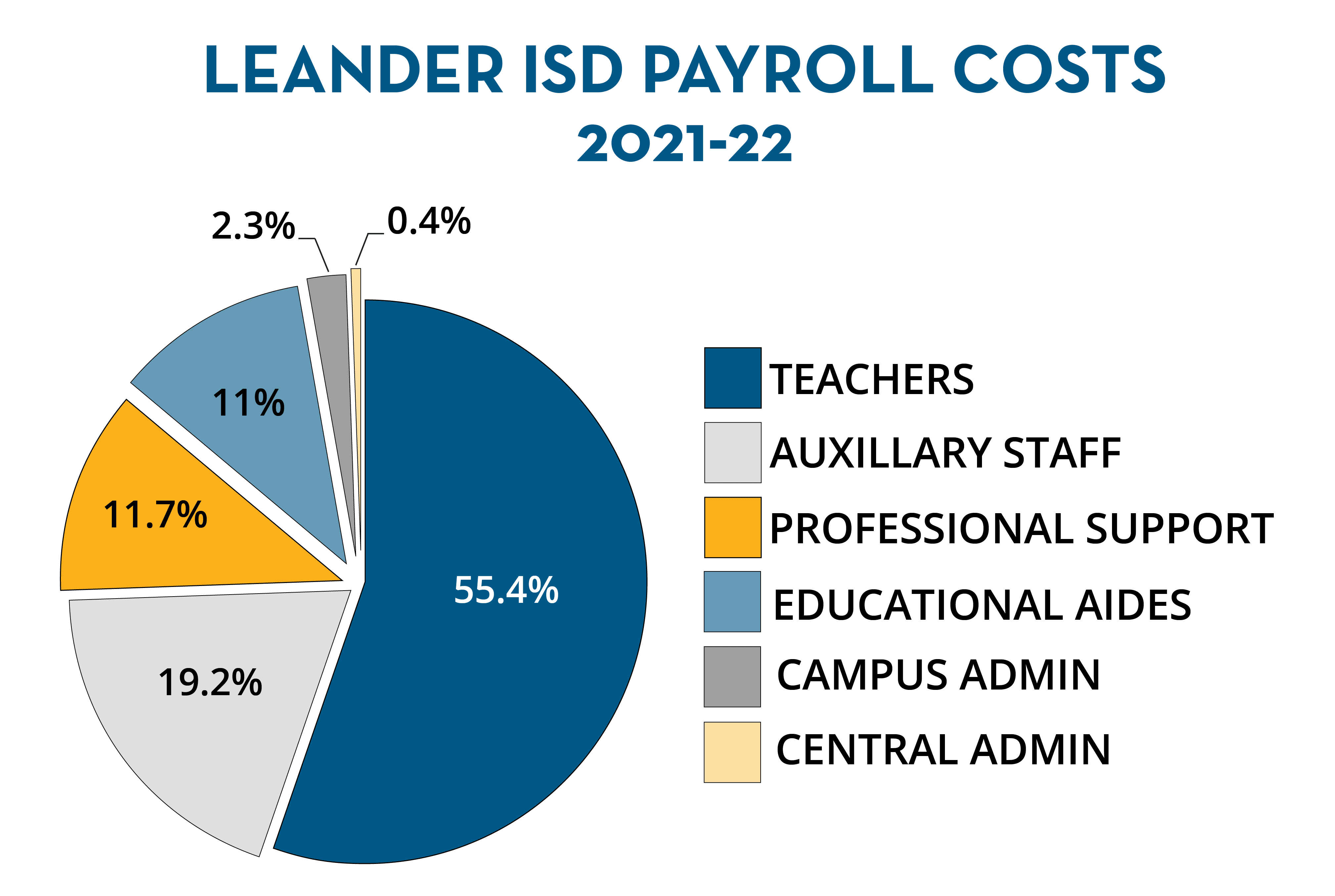

A large share of a school district’s operating budget – the funds accessed by the M&O portion of the tax rate – goes toward payroll. Other expenditures include utilities, contracted services, student educational resources, classroom supplies and equipment, travel and legal and audit services.

Payroll Breakdown

- 55.4% on teachers

- 19.2% on auxiliary staff

- 11.7% on professional support

- 11% on educational aids

- 2.3% on campus administration

- 0.4% on central administration

Fund Balance

A fund balance is like a savings account or emergency account that includes money that school districts do not allocate in budgets and hold in reserve. Fund balance is generated when annual revenues exceed actual operating costs. These funds are used to manage fluctuations in cash flow and to cover unforeseen expenses. Districts with a healthy fund balance also typically earn a higher credit rating because they are viewed as financially sound. More about Leander ISD’s credit rating

Leander ISD’s Board Policy requires the district to have an amount that would cover three months of annual operating expenses. Currently, Leander ISD has a fund balance of a little more than $181 million, which would cover about 6 months of expenses.

Compression of the Tax Rate

HB3 created a system of funding meant to limit the amount of additional revenue generated from the M&O tax rate on rising property values to approximately 2.5 percent year over year. As a result, as property values grow, a school district is required to reduce the M&O tax rate to meet this 2.5-percent cap. Because of this, an increase in property values does not equal a proportional increase in revenues for a school district.

Attendance Credit Election (ACE)

When a school district’s property values generate local revenues that exceed the Tier 1 entitlement, the district has several options to reduce the local revenue levels in excess of the entitlement, including:

- consolidation with another district;

- detachment of territory;

- purchase of average daily attendance credit;

- education of nonresident students; or

- tax base consolidation with another district.

Options 3, 4 and 5 require voter approval. Historically, nearly all school districts choose Option 3, and when Leander ISD has been subject to recapture in the past, it has always chosen Option 3. Under Option 3, due to the size of recapture payments projected for 2022–2023, LISD will no longer be able to “net” its recapture payment against state aid. A school district is now required to hold an election when choosing Option 3 if no longer eligible to net recapture against state aid and if such an election was not held previously – Leander ISD has never held such an election.

This election is called an Attendance Credit Election – also known as a Chapter 49 Election – and requires voters to approve the process by which the school district makes these mandatory recapture payments.

If passed (FOR), the school district would make its mandatory recapture payments to the state as required under Texas law and as was done in previous years. The vote would not change anything within the school district.

If the measure fails (AGAINST), the school district would be subject to a “Detachment of Territory,” meaning the state will detach a portion of the school district’s total property value equal to the amount determined to reduce the recapture payment. However, this Detachment of Territory is permanent and irreversible, even if in future years the property values within the district make it no longer subject to recapture. As a result, the school district might need to raise the I&S tax rate to pay existing debt.

For additional information about the Attendance Credit Election (ACE) on the ballot in the November 2022 election, visit the Elections page.

Voter-Approval Tax Rate Election (VATRE)

State law requires that school districts seek voter approval to raise their M&O tax rate above a rate set by state law.

If the board adopts a tax rate that is greater than the calculated rate set by law, that triggers an election called a Voter-Approval Tax Rate Election (VATRE), which is held on uniform election dates (November). If the voters do not approve the measure, then the M&O tax rate reverts to the maximum rate allowed under state law.

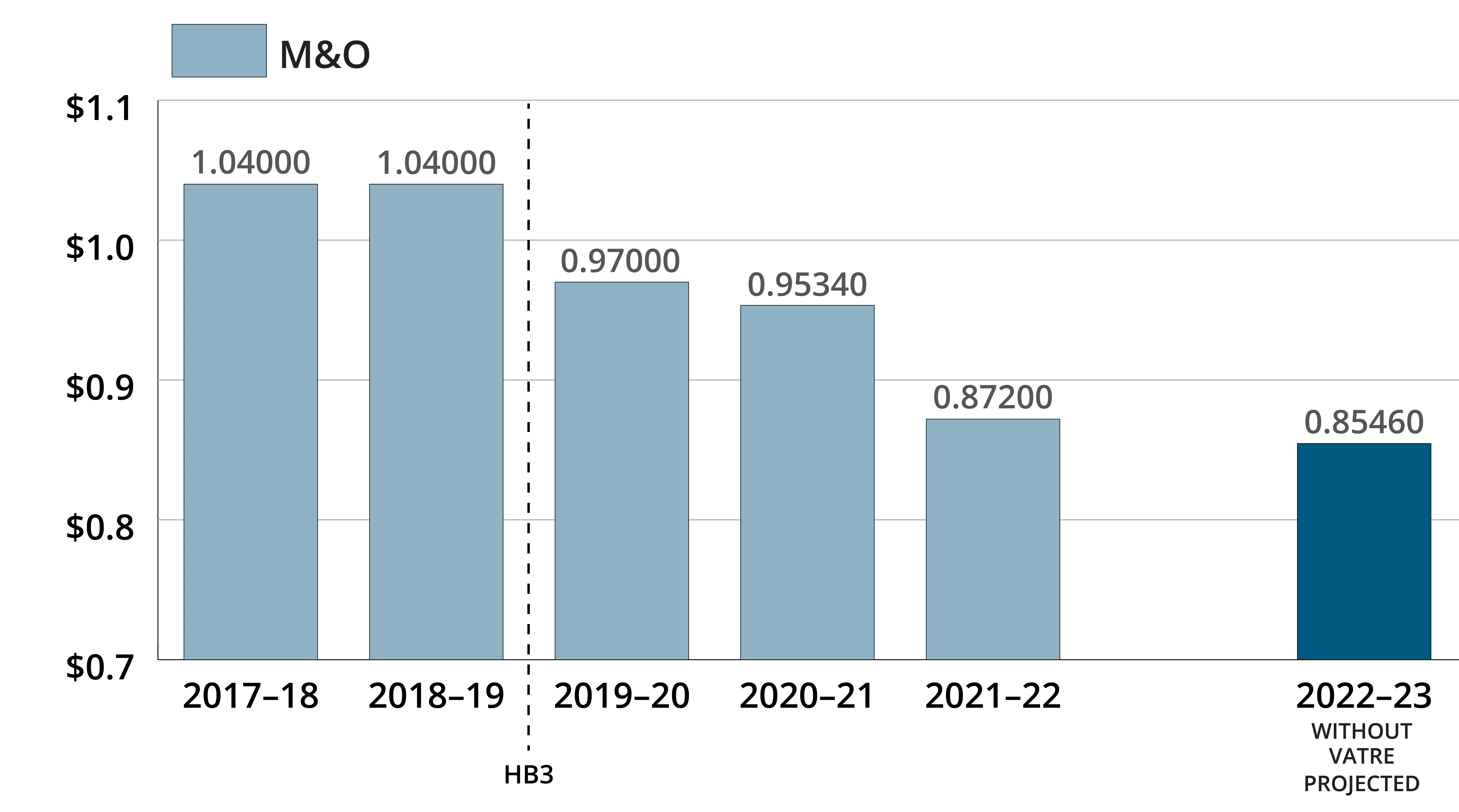

For additional information about how LISD plans to manage the tax rate to increase revenues in an effort to balance the budget, visit the Budget Deficit page. To offset this increase in the M&O tax rate, the district is looking at lowering the I&S by an even greater amount to provide an overall total tax rate decrease.

Note: Even with a decrease in the I&S tax rate, the amount of money available is sufficient to pay down existing debt due to the rise in local property values. For additional information about the I&S tax rate and the district’s amount of debt, visit the I&S section of the Finance 101 page.

Hold Harmless

The Basic Allotment (BA) is set by the Texas legislature, guaranteeing every school district a certain amount of funding for each student based on the Average Daily Attendance (ADA). Based on this formula, the number of students in average daily attendance is directly connected to the amount of revenue a school receives.

At times of crisis or when events outside of a school district’s control have a heavy impact on attendance numbers – such as the COVID19 pandemic – the state can provide a “Hold Harmless,” manually adjusting a school district’s attendance number.

For the Spring of 2020, along with the entire 2020–21 school year, the state provided a “Hold Harmless,” restoring a school district’s ADA to levels seen during previous years, before the start of the pandemic.

Additionally, the state announced in March of 2022 they would extend the Hold Harmless to also include the first four six-week grading periods of the 2021–22 school year. Current estimates indicate this Hold Harmless funding is worth $7 million to Leander ISD.

Acronyms & Definitions

Frequently Asked Questions

What is the current tax rate?

Leander ISD has a current total tax rate of $1.337. The tax rate is made up of two parts: an M&O rate of $0.8720 and an I&S rate of $0.4650.

How do rising property values impact the district?

Rising property values leads to an increase in the amount of tax revenue collected, but this does not mean the school district sees an increase in revenue. There is a relationship between local and state funds where when local tax collections increase, state funds to a school district decrease.

Rising property values do generate additional tax dollars; however, not all of those tax dollars are retained by the district. Excess tax collections are sent back to the state through recapture.

For a more detailed explanation, visit the Budget Mechanics section above.

Why is the district experiencing a deficit?

With the implementation of HB3 (2019) and the COVID-19 pandemic (2020), district revenue has not been growing at the same rate as expenditures. HB3 introduced a cap to an increase of funds generated by the M&O rate year over year.

For a more detailed explanation, visit the Budget Deficit page.

Why are revenues not keeping pace with expenditures?

Expenditures are growing – teacher pay raises, hiring additional teachers, new programs, department budget increases – by $17 million per year. However, we are projecting revenues to only increase by $9 million per year.

A solution to the current budget deficit will require the district to both look for ways to decrease expenditures while also increasing revenue.

For a more detailed explanation of the district’s approach, visit the Budget Deficit page.

By raising the M&O rate and decreasing the I&S rate – a net decrease of the total tax rate – how does the district gain an additional $30 million in revenue without increasing the overall tax rate?

On the current path – without any voter-approved changes – as a result of the required reduction in the M&O rate, also known as compression, we’re expecting the current M&O rate to decrease from $0.8720 to $0.8546. If the Board kept the I&S rate the same at $0.4650, the total rate would decrease to $1.3196, down from $1.3370.

Funds generated from the I&S rate can only be used to pay existing debt, while funds from the M&O rate can be used toward the district’s general budget, things like payroll, utilities, supplies and transportation. Rising property values now generate more tax collections than are needed to service existing debt.

By raising the M&O rate by 9 pennies and offsetting this with a 13.5-penny decrease of the I&S rate, the district would see an additional $30 million in revenue to use toward the general budget, while the total tax rate would come in at a lower amount of $1.27460, down more than 6 cents from the current rate of $1.337.

By raising the M&O rate and decreasing the I&S rate – a net decrease of the total tax rate – what impact does that have on the district’s ability to pay off debt?

There are two important factors to consider when looking at the district’s ability to pay off debt:

- Property values in Leander ISD continue to grow as a result of the huge demand for housing in this desirable community.

- The amount of debt is relatively constant, outside of when new bonds are approved, which allows the district to take on additional debt.

An increase in property values leads to generating more money to pay down that same amount of debt. So the district can decrease the I&S tax rate and get to the same amount of money coming in from before the increase of property values. This results in the district being able to pay down debt at the same pace.

The I&S tax rate gets applied to the full value of growth, not subject to recapture. The M&O tax rate is compressed – capped at 2.5 percent increase of funds – so the district does not get the full value of growth.

What happens if the Attendance Credit Election (ACE) does not pass?

If the measure fails (AGAINST), the school district would be subject to a “Detachment of Territory,” meaning the state will detach a portion of the school district’s total property value equal to the amount determined to reduce the recapture payment.

However, this Detachment of Territory is permanent and irreversible, even if in future years the property values within the district make it no longer subject to recapture. As a result, the school district might need to raise the I&S tax rate to pay existing debt.

For more information on the Attendance Credit Election, visit the Budget Mechanics section above.

What happens if the Voter-Approval Tax Rate Election (VATRE) does not pass?

If the VATRE does not pass, it would hurt the district’s ability to recruit and retain high-quality teachers and staff. The district would lose out on any additional revenue and would be left with a budget deficit of nearly $30 million for the 2022–23 school year.

While fund balance would cover the costs for that school year, the school district would need to increase its amount of cuts in the following areas moving forward:

- A reduction of personnel resulting in increased class sized

- Restructuring or eliminating certain programs that Leander ISD students and parents have come to expect.

For more information on the Voter-Approval Tax Rate Election and how LISD plans to manage the tax rate to bring in additional revenues, visit the Budget Deficit page.

How do I get involved?

To receive Smart Money information – including weekly facts and “Did You Knows” – through Remind and be the first to know of key updates, text @LISDmoney to 81010 to sign up.

If you have a question, submit it through Let’s Talk or by texting 512-399-0068.